How a woman is treated at work and at home impacts her emotional, physical, financial, and mental health.

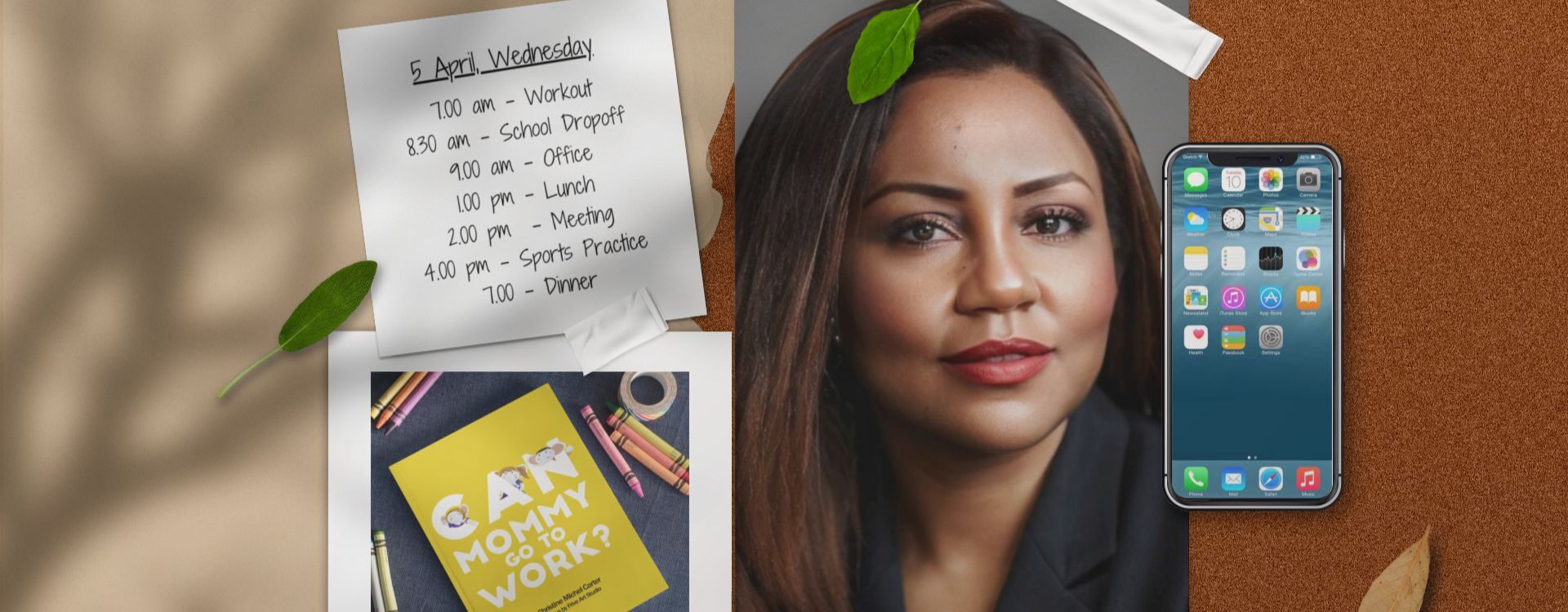

At work, millions of women battle the gender pay gap, toxic femininity, the motherhood penalty, imposter syndrome, burnout, and a lack of ambient belonging. At home, women are struggling with the high costs of raising children. Often, the role of unpaid caregiver falls to women who have to reduce working hours, choose lower-paying jobs, or leave the labor force entirely.

💼 Women are treated unfairly at work, no matter their age or race.

Women in leadership roles are twice as likely to be mistaken for juniors than men. Yet on average, women CEOs are older, partially because it takes them longer to reach such a position. For women who manage teams, burnout goes up to 50%, with 40% considering quitting their careers because of it. Race also impacts work conditions for women. For example, Black women are disproportionately ignored at work and self-report that only 1 in 3 managers check in on them.

🏠 Women are trapped, raising children alone on a tight budget.

The U.S. has no national paid leave policy. Over a quarter of U.S. children under the age of 18 are being raised by single parents, and 80% of single-parent families are headed by single mothers. Yet mothers earn just 54¢ for every dollar a full-time married dad earns, and almost three-quarters of moms — and more than 70% of women without children — say mothers are offered fewer opportunities to move up the corporate ladder.

Don’t leave the workforce.

Stop over-functioning for external validation.

Become a modern leader.

Climb the corporate ladder.

Get past the broken rung.

Christine Michel Carter, acclaimed as "the mom of mom influencers," is a visionary force advocating for empowered working mothers at every stage of life. Her comprehensive support spans from preconception to well beyond the fourth trimester, addressing issues such as maternal mental health, caregiving challenges, and gender equity.